| Small Action | Potential Outcome |

| A change in growth rate assumption | Significant variation in the valuation result |

| A revision in the capital structure | Impact on the weighted average cost of capital |

| A different terminal value estimate | Effects on the present value of the cash flows |

- Sensitivity testing: Understanding the effects of small changes on the final outcome can help DCF analysts refine their models and improve accuracy.

- Modeling assumptions: Identifying the key assumptions that drive the valuation results can enable more informed decision-making.

- Scenario planning: Recognizing the potential impact of small actions can promote more proactive strategic planning and contingency preparation.

Fractals and Self Similarity in DCF Chaos

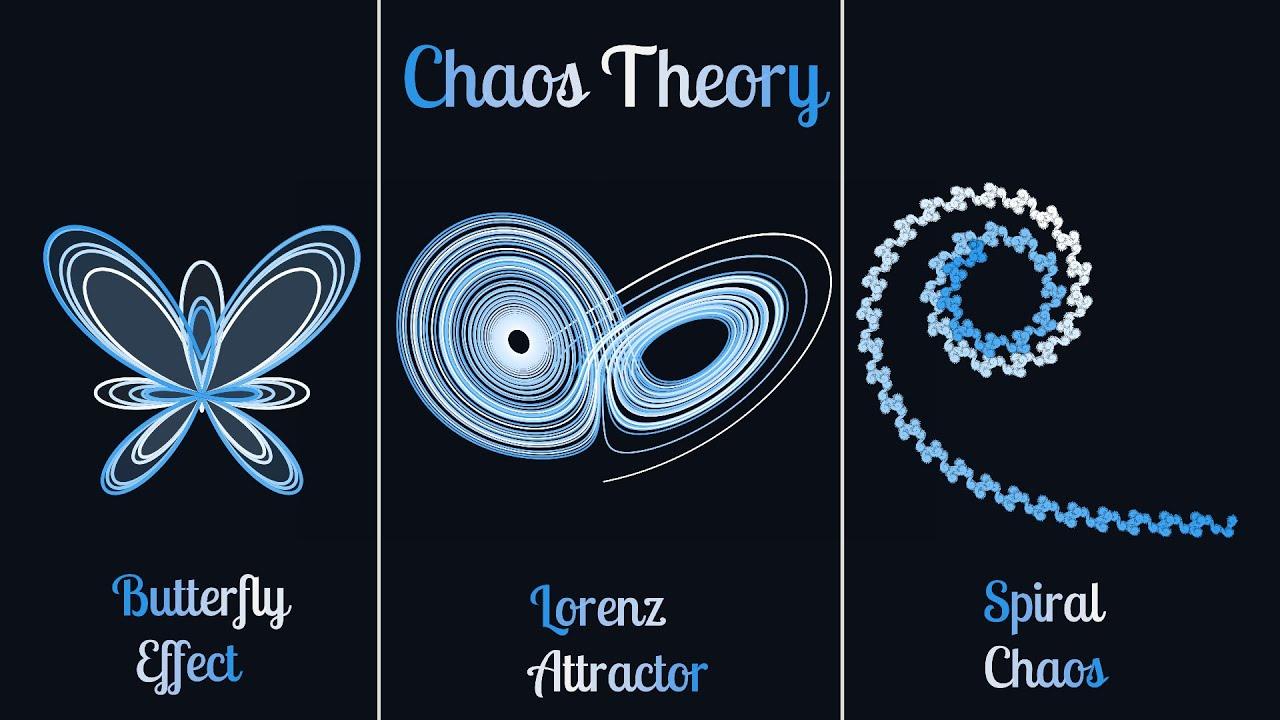

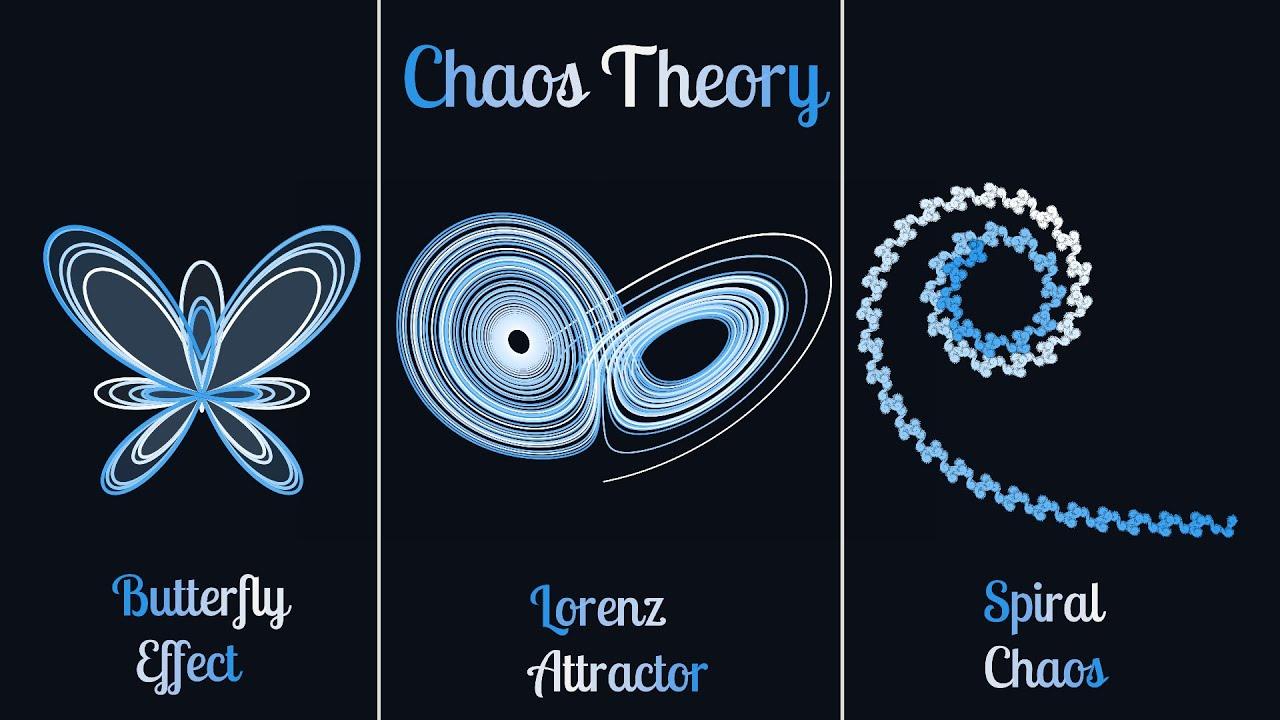

The intricate patterns that govern the universe’s complex systems are a subject of fascination for scientists and mathematicians alike. Among these patterns, fractals and self-similarity play a pivotal role in understanding the chaos that unfolds in the DCF universe. Fractals exhibit a unique property – they appear the same at different scales, with their patterns repeating infinitely, fostering an atmosphere of predictability within the chaotic realm.

These geometric wonders have far-reaching implications in the DCF universe, as they govern various aspects such as the distribution of matter and energy. To illustrate this, consider the following examples:

- The branch-like structure of galaxies, where smaller units mirror the shape of the larger ones.

- Cosmic microwave background radiation patterns, featuring intricate webs of energy that echo the universe’s early configuration.

- Turbulent fluid dynamics, with swirling currents that display self-similar features across multiple scales.

By examining these patterns, researchers can gain insight into the intricate web that binds the universe together. Furthermore, studies have identified key characteristics that are evident in fractals and self-similar systems:

| Characteristics | Description |

|---|---|

| Scaling Symmetry | The property of displaying the same pattern at multiple scales. |

| Infinite Complexity | The existence of intricate details at every scale. |

Predicting the Unpredictable Unfolding of Events

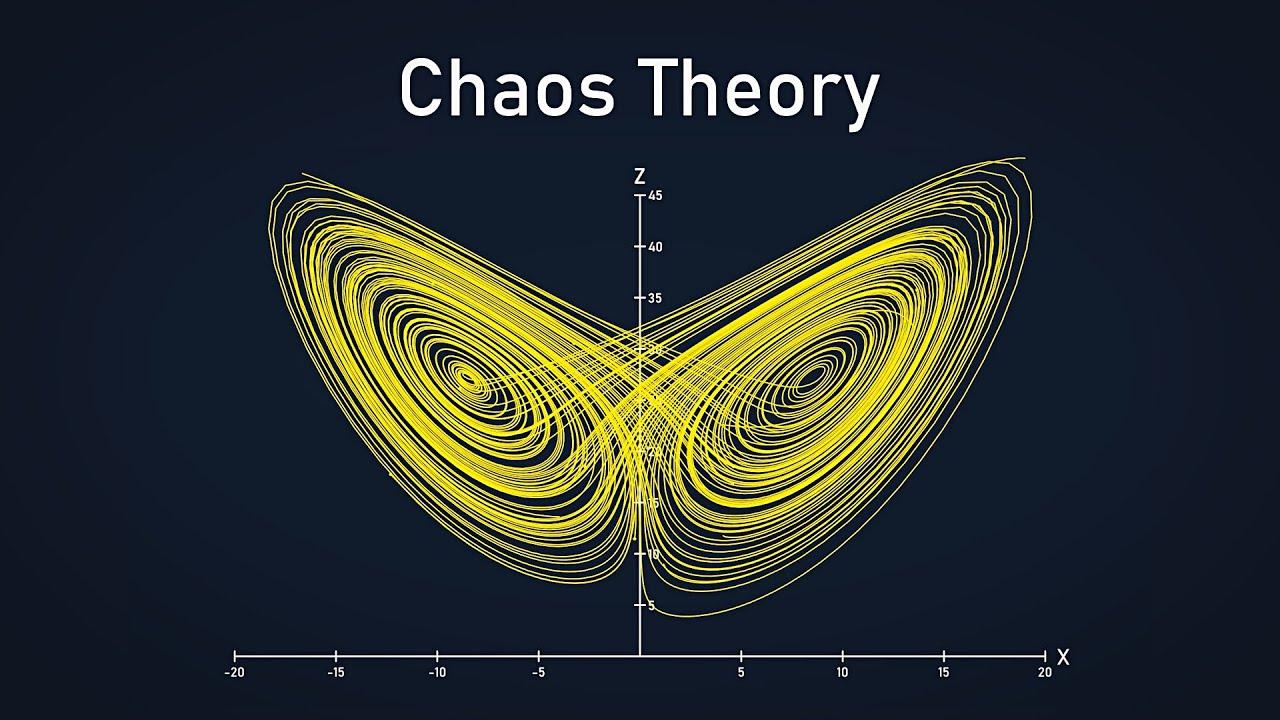

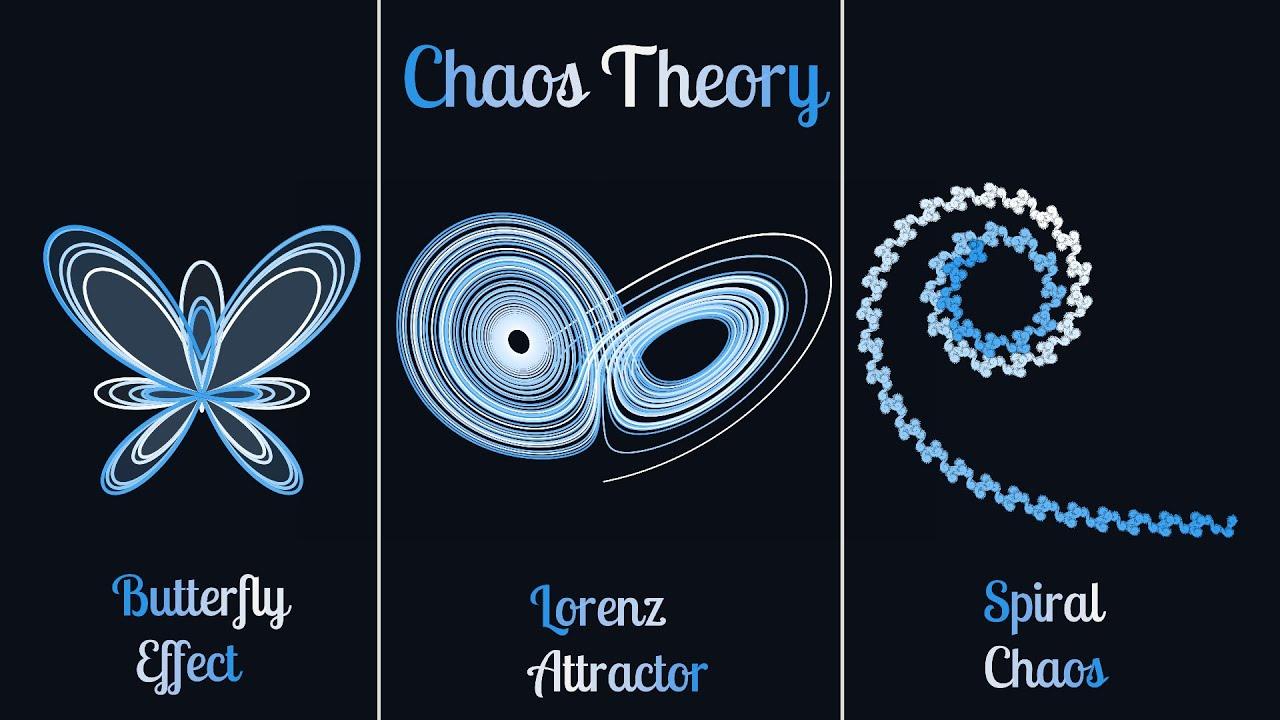

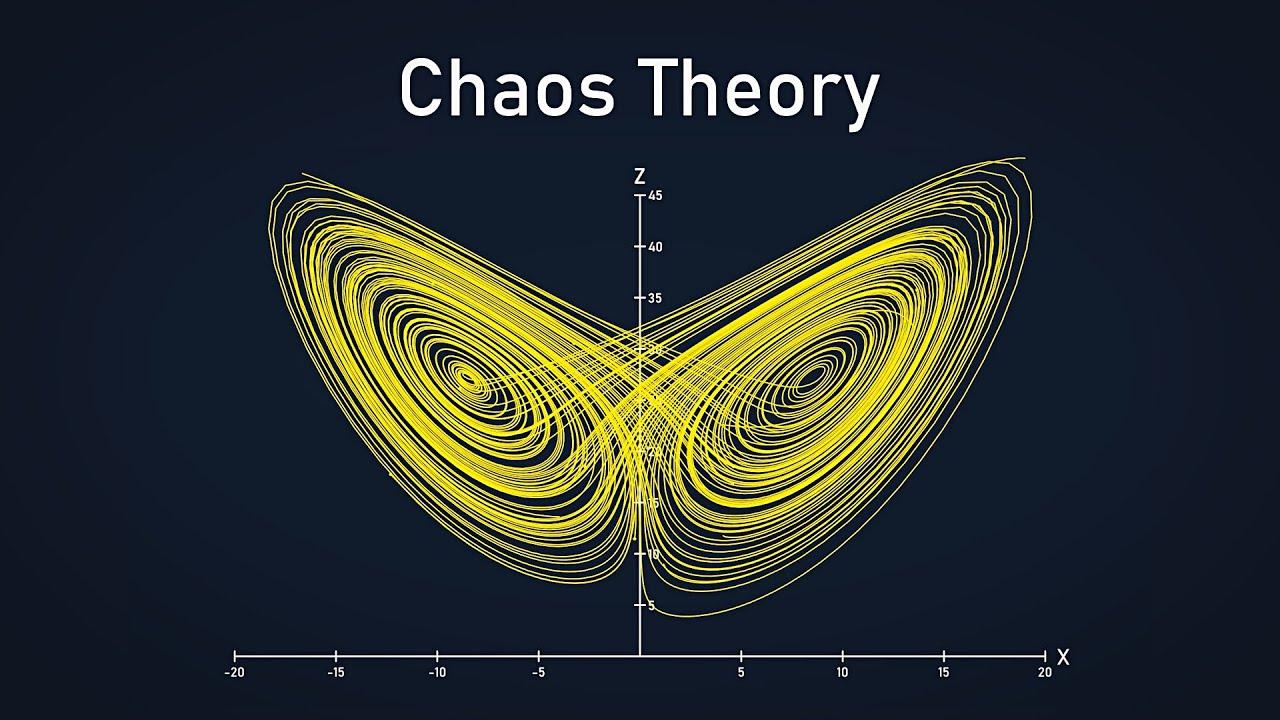

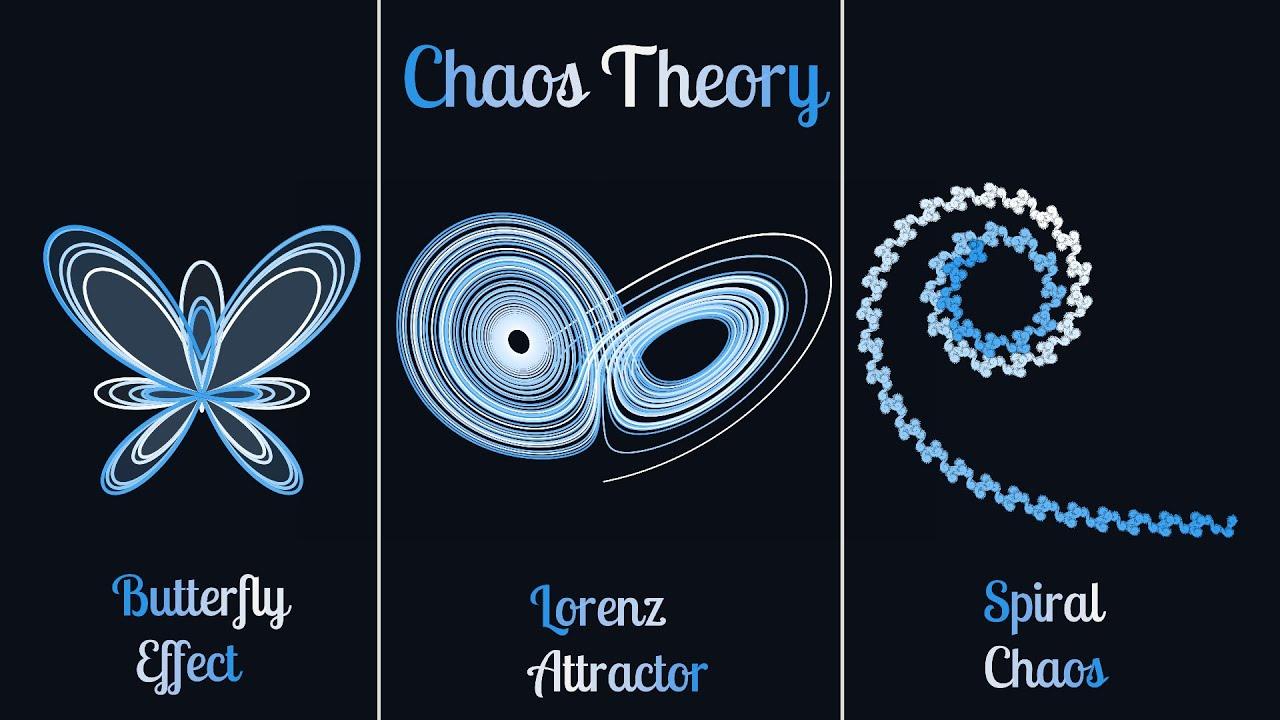

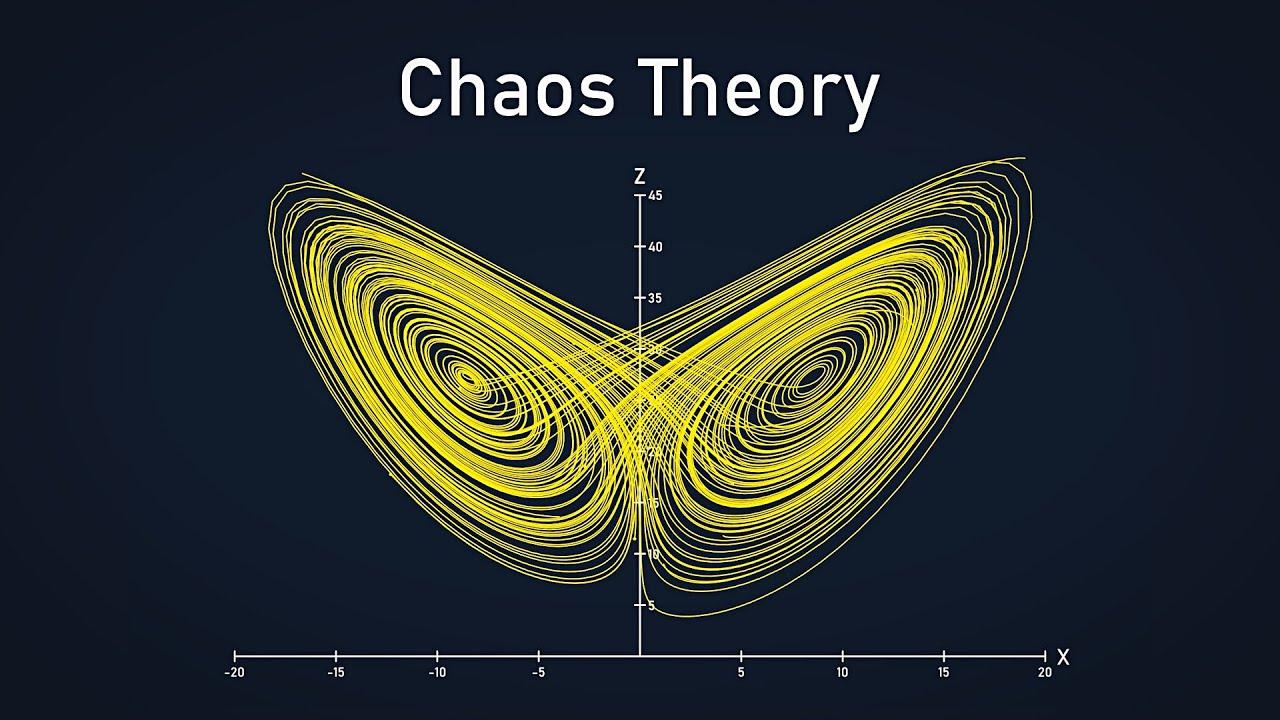

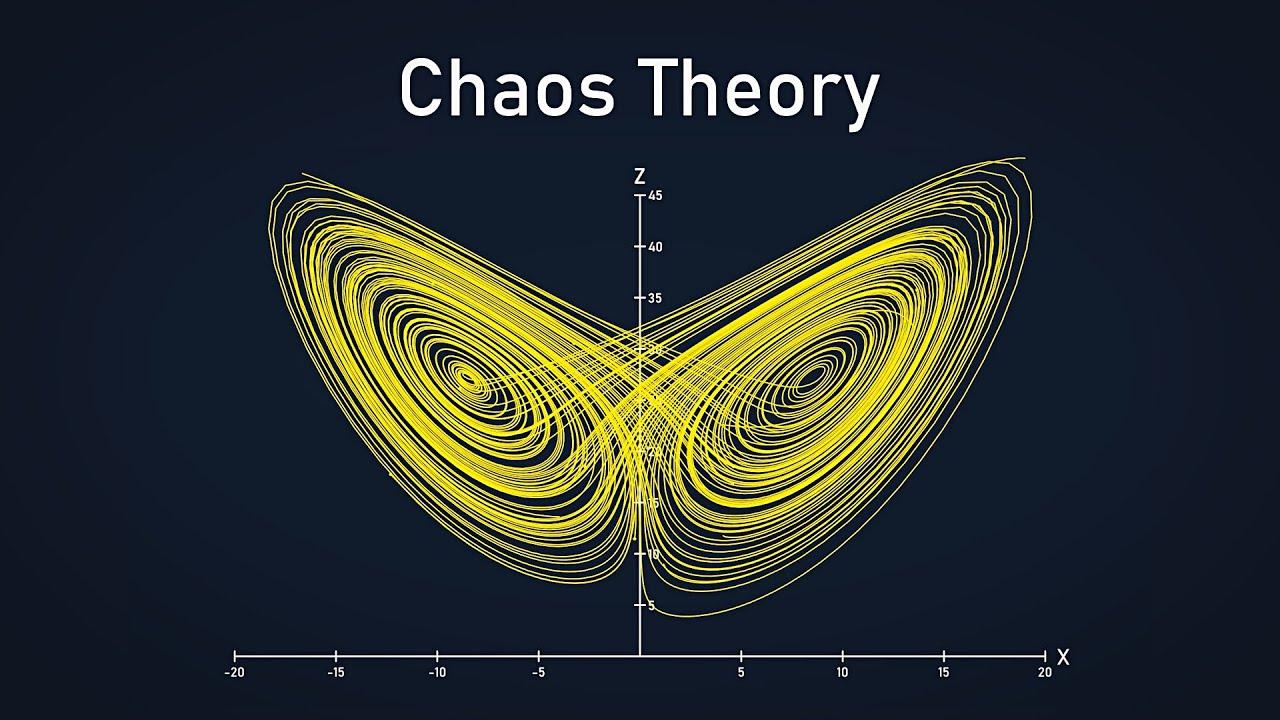

Predicting the future in the DCF universe is akin to trying to forecast the trajectory of a butterfly’s flight. The inherent complexities and intricacies of the universe’s dynamics render predictions prone to error. Even with the most advanced tools and models, uncertainty remains an overriding factor. The key to navigating these uncertainties lies in understanding the underlying principles that govern the universe’s behavior.

In a realm characterized by the interconnectedness of disparate elements, small changes can have far-reaching and unpredictable effects. Consider the following factors that contribute to the complex nature of the DCF universe:

- Flux Intensification: The acceleration of information and idea proliferation, leading to unforeseen consequences.

- Nodal Interactions: The confluence of power nodes, influencing the dynamic equilibrium of the universe.

- Emergent Properties: The manifestation of unforeseen properties and behaviors, arising from complex interactions.

- Feedback Loops: The recursive influence of past events on the present, shaping future outcomes.

| Initial Conditions | Small Change | Unpredictable Outcomes | |

|---|---|---|---|

| Physical Systems | Sensitive dependence | Butterfly effect | Unforeseen weather patterns |

| Social Dynamics | Interconnected networks | Influential actions | Far-reaching social movements |

| Economic Fluctuations | Market sensitivities | Minor market shifts | Avalanche-like economic downturns |

Influencing the Outcome Through Strategic Intervention

Within the complex dynamics of the DCF universe, entities can exercise control over specific variables to shape the course of events. This can be achieved through intentional actions or calculated inactions, generating a ripple effect throughout the system. Strategic manipulation of key factors can amplify or mitigate the Butterfly Effect, leading to more desirable or chaotic outcomes.

- Seeding targeted information within influential networks

- Calibrating systemic parameters to induce resonance

- Data-driven decision making to harmonize or disrupt patterns

- Identification of critical phase transitions to introduce change

- Intentional non-intervention to allow events to unfold naturally

| Strategic Intervention Types | Potential Outcomes |

|---|---|

| Proactive | Reduced uncertainty, increased stability |

| Reactive | Minimized risk, conservation of resources |

| Adaptive | Emergence of novel patterns, growth |

| Predictive | Accuracy in forecasting, efficiency |

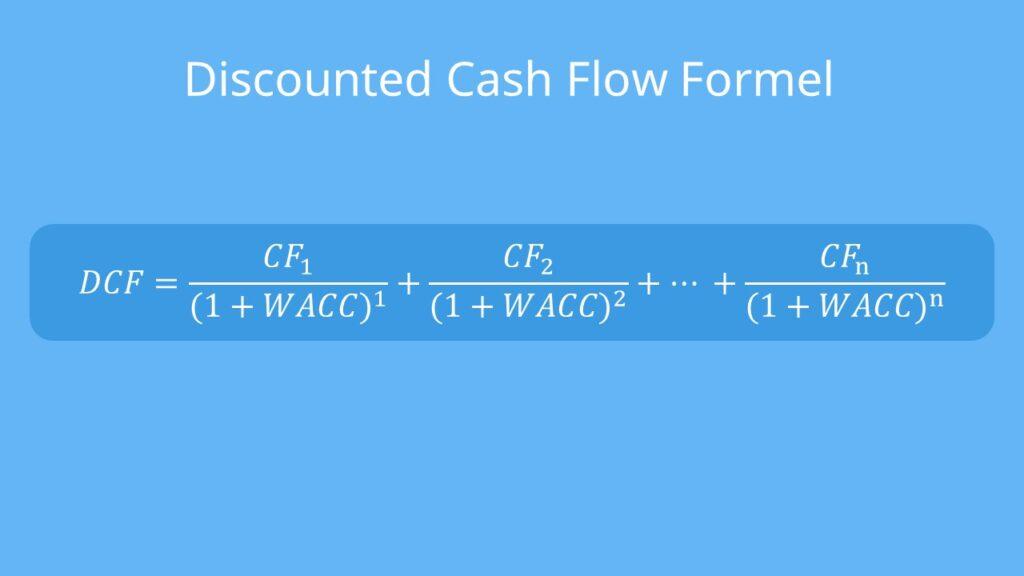

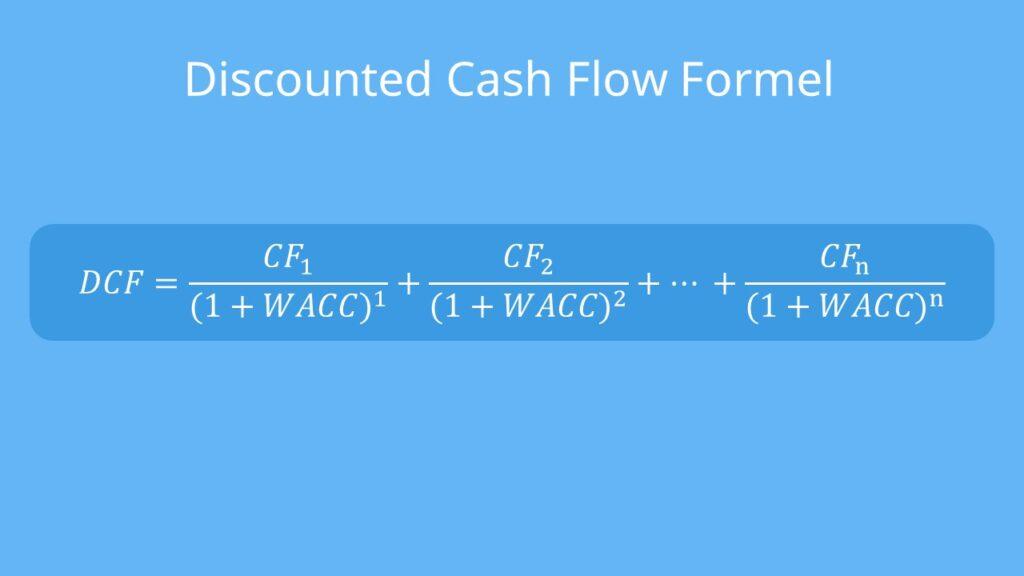

Embracing the Uncertainty Principle in DCF

At its core, the uncertainty principle in DCF analysis revolves around the inherent unpredictability of future cash flows and discount rates, casting a shadow of doubt over the reliability of the calculated present value. Rather than trying to mitigate this uncertainty through futile attempts to conjure precise predictions, it may be wiser to acknowledge and even embrace the chaos, understanding that an element of unpredictability will always be present. By doing so, we open ourselves up to a more flexible and adaptive approach, one that acknowledges the fluidity of market conditions and business performance. The result is a more nuanced understanding of the investment, one that acknowledges both its potential and its limitations.

This paradigm shift can be achieved by incorporating the following elements into the DCF analysis:

- Sensitivity Analysis: By testing different scenarios and outcomes, we can develop a sense of how sensitive our results are to changes in assumptions, allowing us to identify areas where risks are more pronounced.

- Probability-Weighted Cash Flows: Assigning probabilities to different cash flow outcomes enables us to incorporate our best guess of future events, while still acknowledging the uncertainty.

- Adjusting for Increased Uncertainty: By increasing the discount rate or adjusting the terminal growth rate, we can reflect our growing unease with an investment’s prospects, resulting in a more balanced valuation.

It’s interesting to note how “certainty” and “probability” are often at odds in DCF. As shown in the table below, the truth lies in acknowledging that even the most fundamental calculations are just attempts to chart our way through a stormy sea, not to provide an exactitude that does not exist.

| Investment Decisions | Certainty | Probability |

|---|---|---|

| Flawless predictions | High | 0% |

| Accepting some degree of risk | Medium | 50% |

| Embracing chaos and unpredictability | Low | 100% |

Ultimately, it is only once we accept our limitations and confront the inherent uncertainty head-on that we can unlock a deeper understanding of the investment universe and its many mysteries.

Coping Mechanisms for Managing Chaos and Uncertainty

When faced with the unpredictable nature of the DCF universe, it’s essential to develop strategies that allow you to navigate through the challenges with greater ease. One approach is to reframe your thinking, shifting your focus from the chaos itself to the opportunities it presents. By doing so, you can transform uncertainty into a catalyst for growth and innovation. This mindset adjustment enables you to proactively seek solutions rather than simply reacting to the ever-changing environment.

Another approach is to employ grounding techniques to maintain your emotional balance amidst the turmoil. These methods can help you stay centered and composed, even in the face of uncertainty. Some effective grounding techniques include:

- Mindfulness meditation, which encourages you to stay present in the moment and observe your thoughts without judgment

- Deep breathing exercises, which can help calm your nervous system and reduce stress

- Physical activity, such as walking or yoga, which can release endorphins and promote relaxation

- Journaling, which allows you to process your emotions and reflect on your experiences

| Category | Description |

|---|---|

| Physical Self-Care | Activities that promote physical well-being, such as exercise, healthy eating, and sleep |

| Emotional Self-Care | Practices that nurture emotional health, such as meditation, journaling, and therapy |

| Mental Self-Care | Strategies that support mental well-being, such as learning, problem-solving, and creative pursuits |

| Social Self-Care | Activities that foster social connections, such as spending time with loved ones, joining clubs, or volunteering |

Building Resilience in the Face of Turbulence

In the midst of unpredictable events, strength lies not in avoiding the turmoil, but in adapting to the ever-changing landscape. As uncertainty becomes the new normal, resilience takes center stage as a crucial skill to navigate the challenges head-on. One effective way to develop this resilience is by cultivating a strong support network, which can be achieved by:

- Building relationships based on trust and open communication.

- Identifying reliable sources of information to stay informed.

- Participating in online communities to broaden your perspective.

- Collaborating with others to build mutually beneficial partnerships.

- Developing a growth mindset, embracing challenges as opportunities for growth.

Developing resilience also requires a commitment to self-care and stress management. This includes maintaining a healthy work-life balance, engaging in regular physical activity, and practicing mindfulness techniques to reduce stress and anxiety. Effective stress management can be achieved through relaxation techniques , time management, and establishing a daily routine. The benefits of self-care and stress management are well-documented, with stress reduction resulting in:

| Benefits of Self-Care | Outcomes |

|---|---|

| Improved mental health | Increased emotional intelligence |

| Reducing stress and anxiety | Enhanced problem-solving skills |

| Boosting self-esteem | Improved relationships |

The Hidden Patterns Beneath the Surface

The intricacies of the DCF universe are often shrouded in mystery, with the underlying dynamics governing the relationships between variables remaining obscure. To unravel this enigma, one must delve into the realm of patterns, where seemingly unrelated phenomena coalesce into a coherent narrative. Beneath the apparent randomness, the following patterns can be discerned:

- Fractal resonance: A self-similar pattern repeated across various scales, demonstrating an intrinsic interconnectedness between disparate elements.

- Feedback loops: Cycles of causality where the output of a system becomes the input, generating a continuous cycle of change and adaptation.

- Emulation and convergence**: Independent entities mirroring each other’s behaviors, suggesting a global coherence that transcends individual occurrences.

| DCF Pattern | Corresponding Phenomena |

|---|---|

| Fractal resonance | Repeating market cycles, resonant frequencies in physics |

| Feedback loops | Tipping points in climate change, self-reinforcing social trends |

| Emulation and convergence | Convergent evolution in biology, convergent cultural narratives |

Adapting to the Ever Changing DCF Landscape

In the DCF universe, nothing remains constant except change. As the landscape continues to shift, it’s essential to stay adaptable to navigate the complexities of the ever-evolving world of discounted cash flow analysis. One way to approach this is by developing a flexible mindset, where assumptions are continually challenged and recalibrated. This mindset allows for a smoother transition as new information becomes available, and the ability to pivot when circumstances change.

When it comes to building DCF models, modularity and scalability are key. This allows for seamless integration of new data points, assumptions, and scenarios, making it easier to respond to changes in the market or company performance. By breaking down complex models into smaller, more manageable components, users can quickly identify areas of sensitivity and make adjustments as needed. This approach enables users to stay one step ahead in the DCF universe, where uncertainty is the only constant.

- Characteristics of adaptable DCF models:

- Modular design

- Flexibility to accommodate changing assumptions

- Scalability to handle increasing complexity

- Ability to integrate new data points and scenarios

| Stage | Key Characteristics |

|---|---|

| Traditional | Simplified assumptions, single-point estimates |

| Advanced | Probabilistic modeling, decision trees |

| Dynamic | Real-time data integration, scenario planning |

This table illustrates the evolution of DCF analysis, from traditional to dynamic, highlighting key characteristics and advancements.

Harnessing the Power of Chaos for Strategic Advantage

Harnessing chaos requires an organization to be adaptable and responsive to change. By embracing this attribute, companies can transform unstructured and unpredictable events into valuable learning experiences. When leveraged effectively, these experiences can provide a competitive edge and drive business growth. In a chaotic environment, organizations that succeed are those that:

- Stay agile: Develop a culture that encourages quick decision-making and prompt action.

- Monitor and learn: Establish systems to observe and analyze the environment for potential risks and opportunities.

- Encourage experimentation: Allow teams to take calculated risks and engage in creative problem-solving.

- Maintain flexibility: Prioritize processes over rigid structures to facilitate effortless adjustments.

| Characteristics of Chaotic Environments | DFC Response |

|---|---|

| Unpredictability | Develop multiple scenarios and contingency plans |

| Interconnectedness | Foster cross-functional collaboration and partnerships |

| Rapid Change | Prioritize continuous learning and innovation |

Final Thoughts

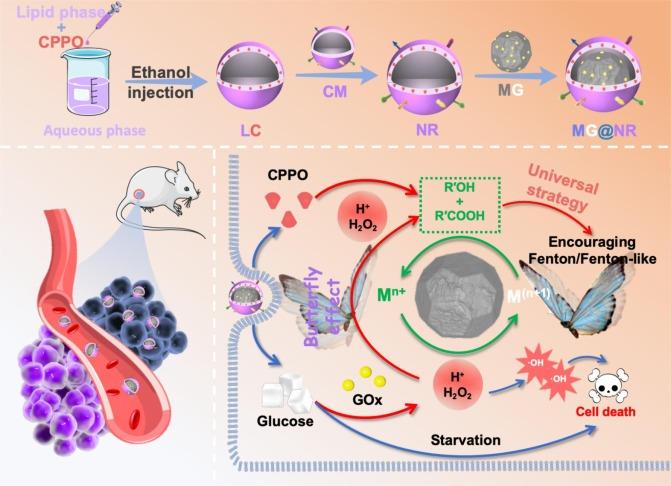

In the grand tapestry of the DCF universe, chaos theory weaves a complex narrative of unpredictability and fascinating disorder. As we navigate the intricate dance of variables and outcomes, we find ourselves drawn into a world where the merest flutter of a butterfly’s wings can send shockwaves through the very fabric of reality. And yet, it is within this maelstrom of uncertainty that we discover the true beauty of the DCF universe. A realm where the forces of disorder and randomness converge to create an ever-changing landscape of possibility and surprise. As we close this exploration of the chaos theory of the DCF universe, we are left with more questions than answers. But it is in the asking of these questions, in the pursuit of understanding the intricate workings of this complex cosmos, that we find the true value of this journey. For it is not the prediction of outcomes that matters, but the thrill of the journey itself. The journey into the unknown, where the only constant is change, and the beauty of chaos reigns supreme.Small actions have tremendous power to shape the DCF universe, making it an fascinating yet unpredictable world. Much like the flapping of a butterfly’s wings, which is said to cause a hurricane on the other side of the world, the effects of seemingly insignificant decisions in the DCF universe can have far-reaching consequences. From the way a figure is displayed on a spreadsheet to the way a cash flow is predicted, the smallest change can set off a chain of reactions that significantly impact the final outcome.

This unpredictability is rooted in the intricate nature of the DCF universe, which is characterized by complex relationships and high sensitivity to initial conditions. Despite this volatility, understanding the butterfly effect can empower DCF analysts and professionals to be more proactive and meticulous in their work, recognizing the potential consequences of even the smallest actions.

| Small Action | Potential Outcome |

| A change in growth rate assumption | Significant variation in the valuation result |

| A revision in the capital structure | Impact on the weighted average cost of capital |

| A different terminal value estimate | Effects on the present value of the cash flows |

- Sensitivity testing: Understanding the effects of small changes on the final outcome can help DCF analysts refine their models and improve accuracy.

- Modeling assumptions: Identifying the key assumptions that drive the valuation results can enable more informed decision-making.

- Scenario planning: Recognizing the potential impact of small actions can promote more proactive strategic planning and contingency preparation.

Fractals and Self Similarity in DCF Chaos

The intricate patterns that govern the universe’s complex systems are a subject of fascination for scientists and mathematicians alike. Among these patterns, fractals and self-similarity play a pivotal role in understanding the chaos that unfolds in the DCF universe. Fractals exhibit a unique property – they appear the same at different scales, with their patterns repeating infinitely, fostering an atmosphere of predictability within the chaotic realm.

These geometric wonders have far-reaching implications in the DCF universe, as they govern various aspects such as the distribution of matter and energy. To illustrate this, consider the following examples:

- The branch-like structure of galaxies, where smaller units mirror the shape of the larger ones.

- Cosmic microwave background radiation patterns, featuring intricate webs of energy that echo the universe’s early configuration.

- Turbulent fluid dynamics, with swirling currents that display self-similar features across multiple scales.

By examining these patterns, researchers can gain insight into the intricate web that binds the universe together. Furthermore, studies have identified key characteristics that are evident in fractals and self-similar systems:

| Characteristics | Description |

|---|---|

| Scaling Symmetry | The property of displaying the same pattern at multiple scales. |

| Infinite Complexity | The existence of intricate details at every scale. |

Predicting the Unpredictable Unfolding of Events

Predicting the future in the DCF universe is akin to trying to forecast the trajectory of a butterfly’s flight. The inherent complexities and intricacies of the universe’s dynamics render predictions prone to error. Even with the most advanced tools and models, uncertainty remains an overriding factor. The key to navigating these uncertainties lies in understanding the underlying principles that govern the universe’s behavior.

In a realm characterized by the interconnectedness of disparate elements, small changes can have far-reaching and unpredictable effects. Consider the following factors that contribute to the complex nature of the DCF universe:

- Flux Intensification: The acceleration of information and idea proliferation, leading to unforeseen consequences.

- Nodal Interactions: The confluence of power nodes, influencing the dynamic equilibrium of the universe.

- Emergent Properties: The manifestation of unforeseen properties and behaviors, arising from complex interactions.

- Feedback Loops: The recursive influence of past events on the present, shaping future outcomes.

| Initial Conditions | Small Change | Unpredictable Outcomes | |

|---|---|---|---|

| Physical Systems | Sensitive dependence | Butterfly effect | Unforeseen weather patterns |

| Social Dynamics | Interconnected networks | Influential actions | Far-reaching social movements |

| Economic Fluctuations | Market sensitivities | Minor market shifts | Avalanche-like economic downturns |

Influencing the Outcome Through Strategic Intervention

Within the complex dynamics of the DCF universe, entities can exercise control over specific variables to shape the course of events. This can be achieved through intentional actions or calculated inactions, generating a ripple effect throughout the system. Strategic manipulation of key factors can amplify or mitigate the Butterfly Effect, leading to more desirable or chaotic outcomes.

- Seeding targeted information within influential networks

- Calibrating systemic parameters to induce resonance

- Data-driven decision making to harmonize or disrupt patterns

- Identification of critical phase transitions to introduce change

- Intentional non-intervention to allow events to unfold naturally

| Strategic Intervention Types | Potential Outcomes |

|---|---|

| Proactive | Reduced uncertainty, increased stability |

| Reactive | Minimized risk, conservation of resources |

| Adaptive | Emergence of novel patterns, growth |

| Predictive | Accuracy in forecasting, efficiency |

Embracing the Uncertainty Principle in DCF

At its core, the uncertainty principle in DCF analysis revolves around the inherent unpredictability of future cash flows and discount rates, casting a shadow of doubt over the reliability of the calculated present value. Rather than trying to mitigate this uncertainty through futile attempts to conjure precise predictions, it may be wiser to acknowledge and even embrace the chaos, understanding that an element of unpredictability will always be present. By doing so, we open ourselves up to a more flexible and adaptive approach, one that acknowledges the fluidity of market conditions and business performance. The result is a more nuanced understanding of the investment, one that acknowledges both its potential and its limitations.

This paradigm shift can be achieved by incorporating the following elements into the DCF analysis:

- Sensitivity Analysis: By testing different scenarios and outcomes, we can develop a sense of how sensitive our results are to changes in assumptions, allowing us to identify areas where risks are more pronounced.

- Probability-Weighted Cash Flows: Assigning probabilities to different cash flow outcomes enables us to incorporate our best guess of future events, while still acknowledging the uncertainty.

- Adjusting for Increased Uncertainty: By increasing the discount rate or adjusting the terminal growth rate, we can reflect our growing unease with an investment’s prospects, resulting in a more balanced valuation.

It’s interesting to note how “certainty” and “probability” are often at odds in DCF. As shown in the table below, the truth lies in acknowledging that even the most fundamental calculations are just attempts to chart our way through a stormy sea, not to provide an exactitude that does not exist.

| Investment Decisions | Certainty | Probability |

|---|---|---|

| Flawless predictions | High | 0% |

| Accepting some degree of risk | Medium | 50% |

| Embracing chaos and unpredictability | Low | 100% |

Ultimately, it is only once we accept our limitations and confront the inherent uncertainty head-on that we can unlock a deeper understanding of the investment universe and its many mysteries.

Coping Mechanisms for Managing Chaos and Uncertainty

When faced with the unpredictable nature of the DCF universe, it’s essential to develop strategies that allow you to navigate through the challenges with greater ease. One approach is to reframe your thinking, shifting your focus from the chaos itself to the opportunities it presents. By doing so, you can transform uncertainty into a catalyst for growth and innovation. This mindset adjustment enables you to proactively seek solutions rather than simply reacting to the ever-changing environment.

Another approach is to employ grounding techniques to maintain your emotional balance amidst the turmoil. These methods can help you stay centered and composed, even in the face of uncertainty. Some effective grounding techniques include:

- Mindfulness meditation, which encourages you to stay present in the moment and observe your thoughts without judgment

- Deep breathing exercises, which can help calm your nervous system and reduce stress

- Physical activity, such as walking or yoga, which can release endorphins and promote relaxation

- Journaling, which allows you to process your emotions and reflect on your experiences

| Category | Description |

|---|---|

| Physical Self-Care | Activities that promote physical well-being, such as exercise, healthy eating, and sleep |

| Emotional Self-Care | Practices that nurture emotional health, such as meditation, journaling, and therapy |

| Mental Self-Care | Strategies that support mental well-being, such as learning, problem-solving, and creative pursuits |

| Social Self-Care | Activities that foster social connections, such as spending time with loved ones, joining clubs, or volunteering |

Building Resilience in the Face of Turbulence

In the midst of unpredictable events, strength lies not in avoiding the turmoil, but in adapting to the ever-changing landscape. As uncertainty becomes the new normal, resilience takes center stage as a crucial skill to navigate the challenges head-on. One effective way to develop this resilience is by cultivating a strong support network, which can be achieved by:

- Building relationships based on trust and open communication.

- Identifying reliable sources of information to stay informed.

- Participating in online communities to broaden your perspective.

- Collaborating with others to build mutually beneficial partnerships.

- Developing a growth mindset, embracing challenges as opportunities for growth.

Developing resilience also requires a commitment to self-care and stress management. This includes maintaining a healthy work-life balance, engaging in regular physical activity, and practicing mindfulness techniques to reduce stress and anxiety. Effective stress management can be achieved through relaxation techniques , time management, and establishing a daily routine. The benefits of self-care and stress management are well-documented, with stress reduction resulting in:

| Benefits of Self-Care | Outcomes |

|---|---|

| Improved mental health | Increased emotional intelligence |

| Reducing stress and anxiety | Enhanced problem-solving skills |

| Boosting self-esteem | Improved relationships |

The Hidden Patterns Beneath the Surface

The intricacies of the DCF universe are often shrouded in mystery, with the underlying dynamics governing the relationships between variables remaining obscure. To unravel this enigma, one must delve into the realm of patterns, where seemingly unrelated phenomena coalesce into a coherent narrative. Beneath the apparent randomness, the following patterns can be discerned:

- Fractal resonance: A self-similar pattern repeated across various scales, demonstrating an intrinsic interconnectedness between disparate elements.

- Feedback loops: Cycles of causality where the output of a system becomes the input, generating a continuous cycle of change and adaptation.

- Emulation and convergence**: Independent entities mirroring each other’s behaviors, suggesting a global coherence that transcends individual occurrences.

| DCF Pattern | Corresponding Phenomena |

|---|---|

| Fractal resonance | Repeating market cycles, resonant frequencies in physics |

| Feedback loops | Tipping points in climate change, self-reinforcing social trends |

| Emulation and convergence | Convergent evolution in biology, convergent cultural narratives |

Adapting to the Ever Changing DCF Landscape

In the DCF universe, nothing remains constant except change. As the landscape continues to shift, it’s essential to stay adaptable to navigate the complexities of the ever-evolving world of discounted cash flow analysis. One way to approach this is by developing a flexible mindset, where assumptions are continually challenged and recalibrated. This mindset allows for a smoother transition as new information becomes available, and the ability to pivot when circumstances change.

When it comes to building DCF models, modularity and scalability are key. This allows for seamless integration of new data points, assumptions, and scenarios, making it easier to respond to changes in the market or company performance. By breaking down complex models into smaller, more manageable components, users can quickly identify areas of sensitivity and make adjustments as needed. This approach enables users to stay one step ahead in the DCF universe, where uncertainty is the only constant.

- Characteristics of adaptable DCF models:

- Modular design

- Flexibility to accommodate changing assumptions

- Scalability to handle increasing complexity

- Ability to integrate new data points and scenarios

| Stage | Key Characteristics |

|---|---|

| Traditional | Simplified assumptions, single-point estimates |

| Advanced | Probabilistic modeling, decision trees |

| Dynamic | Real-time data integration, scenario planning |

This table illustrates the evolution of DCF analysis, from traditional to dynamic, highlighting key characteristics and advancements.

Harnessing the Power of Chaos for Strategic Advantage

Harnessing chaos requires an organization to be adaptable and responsive to change. By embracing this attribute, companies can transform unstructured and unpredictable events into valuable learning experiences. When leveraged effectively, these experiences can provide a competitive edge and drive business growth. In a chaotic environment, organizations that succeed are those that:

- Stay agile: Develop a culture that encourages quick decision-making and prompt action.

- Monitor and learn: Establish systems to observe and analyze the environment for potential risks and opportunities.

- Encourage experimentation: Allow teams to take calculated risks and engage in creative problem-solving.

- Maintain flexibility: Prioritize processes over rigid structures to facilitate effortless adjustments.

| Characteristics of Chaotic Environments | DFC Response |

|---|---|

| Unpredictability | Develop multiple scenarios and contingency plans |

| Interconnectedness | Foster cross-functional collaboration and partnerships |

| Rapid Change | Prioritize continuous learning and innovation |

Final Thoughts

In the grand tapestry of the DCF universe, chaos theory weaves a complex narrative of unpredictability and fascinating disorder. As we navigate the intricate dance of variables and outcomes, we find ourselves drawn into a world where the merest flutter of a butterfly’s wings can send shockwaves through the very fabric of reality. And yet, it is within this maelstrom of uncertainty that we discover the true beauty of the DCF universe. A realm where the forces of disorder and randomness converge to create an ever-changing landscape of possibility and surprise. As we close this exploration of the chaos theory of the DCF universe, we are left with more questions than answers. But it is in the asking of these questions, in the pursuit of understanding the intricate workings of this complex cosmos, that we find the true value of this journey. For it is not the prediction of outcomes that matters, but the thrill of the journey itself. The journey into the unknown, where the only constant is change, and the beauty of chaos reigns supreme. In the vast expanse of the DC Comics universe, a multitude of characters, storylines, and plot twists have coalesced to form a rich tapestry of intricate relationships and unpredictable outcomes. Within this complex framework, a fascinating phenomenon has begun to emerge – the Chaos Theory of the DCF Universe. Like the butterfly effect in meteorology, where the flapping of wings can trigger a hurricane, even the smallest actions and events in this universe can set off chain reactions, birthing alternate realities and unforeseen realities. In this realm, the slightest adjustments can reshape entire worlds, testing the boundaries of the reader’s imagination and making the seemingly improbable, utterly possible. So, lock your doors, hide your Bat-alarms, and strap on your crash helmet, as we’re about to dive headfirst into the kaleidoscope of “The Chaos Theory of the DCF Universe” – and the weird, wonderful chaos that ensues.

Navigating the Complex Web of Variables

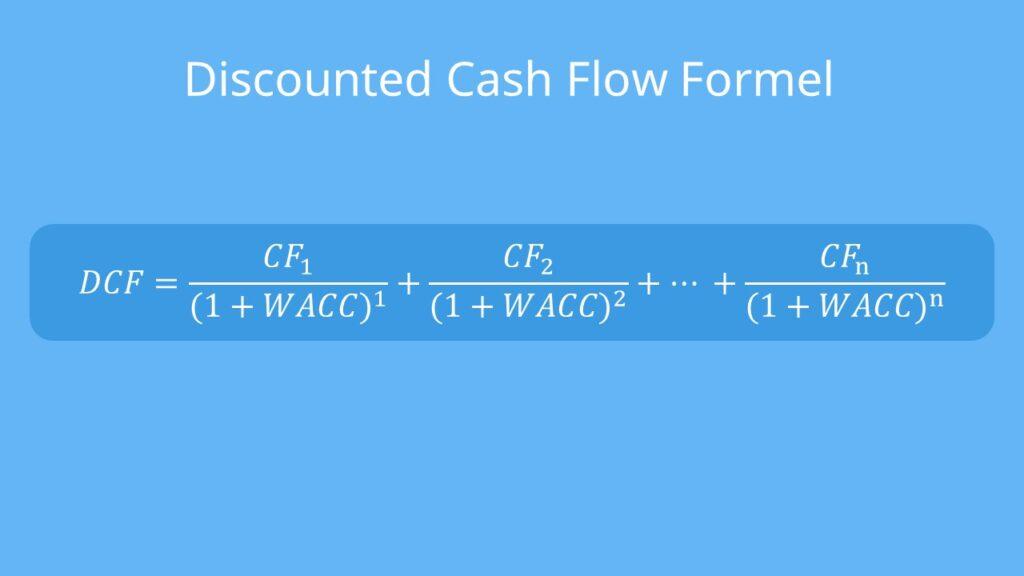

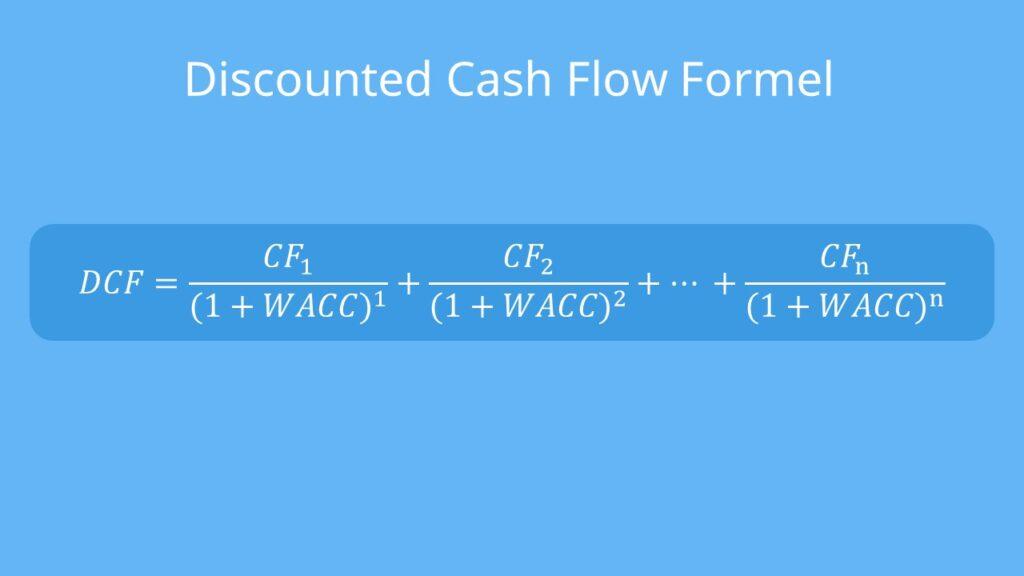

Navigating the intricate pathways of discounted cash flow (DCF) valuations can be likened to traversing a labyrinth, where every twist and turn presents an unexpected variable. Market analysts and financial modelers alike are often faced with the daunting task of incorporating complexities and reconciling divergent forecasts. Key factors influencing this uncharted territory include:

- Volatility in market sentiment, where fluctuations in investor attitudes profoundly impact projected cash flows.

- Regulatory factors and macroeconomic conditions, which can either augment or diminish an organization’s revenue and profitability prospects.

Just as the gentle flutter of a butterfly’s wings can precipitate a tempest, so too can small discrepancies in DCF inputs amplify to become profound risks, affecting both profit projections and stakeholders’ interests. As a case in point, consider the subtle yet profound impact of altering one’s discount rate (WACC) on valuation outcomes:

| Discount Rate (WACC) | Resultant Valuation Outcome (per share) |

|---|---|

| 8.0% | $252.50 |

| 9.5% | $182.20 |

| 11.0% | $132.15 |

Small adjustments in valuation estimates can yield vastly divergent results, creating an environment where both precision and proactive adaptability become the hallmarks of navigable success within this complex DCF realm.

Understanding the Butterfly Effect in DCF Universe

Small actions have tremendous power to shape the DCF universe, making it an fascinating yet unpredictable world. Much like the flapping of a butterfly’s wings, which is said to cause a hurricane on the other side of the world, the effects of seemingly insignificant decisions in the DCF universe can have far-reaching consequences. From the way a figure is displayed on a spreadsheet to the way a cash flow is predicted, the smallest change can set off a chain of reactions that significantly impact the final outcome.

This unpredictability is rooted in the intricate nature of the DCF universe, which is characterized by complex relationships and high sensitivity to initial conditions. Despite this volatility, understanding the butterfly effect can empower DCF analysts and professionals to be more proactive and meticulous in their work, recognizing the potential consequences of even the smallest actions.

| Small Action | Potential Outcome |

| A change in growth rate assumption | Significant variation in the valuation result |

| A revision in the capital structure | Impact on the weighted average cost of capital |

| A different terminal value estimate | Effects on the present value of the cash flows |

- Sensitivity testing: Understanding the effects of small changes on the final outcome can help DCF analysts refine their models and improve accuracy.

- Modeling assumptions: Identifying the key assumptions that drive the valuation results can enable more informed decision-making.

- Scenario planning: Recognizing the potential impact of small actions can promote more proactive strategic planning and contingency preparation.

Fractals and Self Similarity in DCF Chaos

The intricate patterns that govern the universe’s complex systems are a subject of fascination for scientists and mathematicians alike. Among these patterns, fractals and self-similarity play a pivotal role in understanding the chaos that unfolds in the DCF universe. Fractals exhibit a unique property – they appear the same at different scales, with their patterns repeating infinitely, fostering an atmosphere of predictability within the chaotic realm.

These geometric wonders have far-reaching implications in the DCF universe, as they govern various aspects such as the distribution of matter and energy. To illustrate this, consider the following examples:

- The branch-like structure of galaxies, where smaller units mirror the shape of the larger ones.

- Cosmic microwave background radiation patterns, featuring intricate webs of energy that echo the universe’s early configuration.

- Turbulent fluid dynamics, with swirling currents that display self-similar features across multiple scales.

By examining these patterns, researchers can gain insight into the intricate web that binds the universe together. Furthermore, studies have identified key characteristics that are evident in fractals and self-similar systems:

| Characteristics | Description |

|---|---|

| Scaling Symmetry | The property of displaying the same pattern at multiple scales. |

| Infinite Complexity | The existence of intricate details at every scale. |

Predicting the Unpredictable Unfolding of Events

Predicting the future in the DCF universe is akin to trying to forecast the trajectory of a butterfly’s flight. The inherent complexities and intricacies of the universe’s dynamics render predictions prone to error. Even with the most advanced tools and models, uncertainty remains an overriding factor. The key to navigating these uncertainties lies in understanding the underlying principles that govern the universe’s behavior.

In a realm characterized by the interconnectedness of disparate elements, small changes can have far-reaching and unpredictable effects. Consider the following factors that contribute to the complex nature of the DCF universe:

- Flux Intensification: The acceleration of information and idea proliferation, leading to unforeseen consequences.

- Nodal Interactions: The confluence of power nodes, influencing the dynamic equilibrium of the universe.

- Emergent Properties: The manifestation of unforeseen properties and behaviors, arising from complex interactions.

- Feedback Loops: The recursive influence of past events on the present, shaping future outcomes.

| Initial Conditions | Small Change | Unpredictable Outcomes | |

|---|---|---|---|

| Physical Systems | Sensitive dependence | Butterfly effect | Unforeseen weather patterns |

| Social Dynamics | Interconnected networks | Influential actions | Far-reaching social movements |

| Economic Fluctuations | Market sensitivities | Minor market shifts | Avalanche-like economic downturns |

Influencing the Outcome Through Strategic Intervention

Within the complex dynamics of the DCF universe, entities can exercise control over specific variables to shape the course of events. This can be achieved through intentional actions or calculated inactions, generating a ripple effect throughout the system. Strategic manipulation of key factors can amplify or mitigate the Butterfly Effect, leading to more desirable or chaotic outcomes.

- Seeding targeted information within influential networks

- Calibrating systemic parameters to induce resonance

- Data-driven decision making to harmonize or disrupt patterns

- Identification of critical phase transitions to introduce change

- Intentional non-intervention to allow events to unfold naturally

| Strategic Intervention Types | Potential Outcomes |

|---|---|

| Proactive | Reduced uncertainty, increased stability |

| Reactive | Minimized risk, conservation of resources |

| Adaptive | Emergence of novel patterns, growth |

| Predictive | Accuracy in forecasting, efficiency |

Embracing the Uncertainty Principle in DCF

At its core, the uncertainty principle in DCF analysis revolves around the inherent unpredictability of future cash flows and discount rates, casting a shadow of doubt over the reliability of the calculated present value. Rather than trying to mitigate this uncertainty through futile attempts to conjure precise predictions, it may be wiser to acknowledge and even embrace the chaos, understanding that an element of unpredictability will always be present. By doing so, we open ourselves up to a more flexible and adaptive approach, one that acknowledges the fluidity of market conditions and business performance. The result is a more nuanced understanding of the investment, one that acknowledges both its potential and its limitations.

This paradigm shift can be achieved by incorporating the following elements into the DCF analysis:

- Sensitivity Analysis: By testing different scenarios and outcomes, we can develop a sense of how sensitive our results are to changes in assumptions, allowing us to identify areas where risks are more pronounced.

- Probability-Weighted Cash Flows: Assigning probabilities to different cash flow outcomes enables us to incorporate our best guess of future events, while still acknowledging the uncertainty.

- Adjusting for Increased Uncertainty: By increasing the discount rate or adjusting the terminal growth rate, we can reflect our growing unease with an investment’s prospects, resulting in a more balanced valuation.

It’s interesting to note how “certainty” and “probability” are often at odds in DCF. As shown in the table below, the truth lies in acknowledging that even the most fundamental calculations are just attempts to chart our way through a stormy sea, not to provide an exactitude that does not exist.

| Investment Decisions | Certainty | Probability |

|---|---|---|

| Flawless predictions | High | 0% |

| Accepting some degree of risk | Medium | 50% |

| Embracing chaos and unpredictability | Low | 100% |

Ultimately, it is only once we accept our limitations and confront the inherent uncertainty head-on that we can unlock a deeper understanding of the investment universe and its many mysteries.

Coping Mechanisms for Managing Chaos and Uncertainty

When faced with the unpredictable nature of the DCF universe, it’s essential to develop strategies that allow you to navigate through the challenges with greater ease. One approach is to reframe your thinking, shifting your focus from the chaos itself to the opportunities it presents. By doing so, you can transform uncertainty into a catalyst for growth and innovation. This mindset adjustment enables you to proactively seek solutions rather than simply reacting to the ever-changing environment.

Another approach is to employ grounding techniques to maintain your emotional balance amidst the turmoil. These methods can help you stay centered and composed, even in the face of uncertainty. Some effective grounding techniques include:

- Mindfulness meditation, which encourages you to stay present in the moment and observe your thoughts without judgment

- Deep breathing exercises, which can help calm your nervous system and reduce stress

- Physical activity, such as walking or yoga, which can release endorphins and promote relaxation

- Journaling, which allows you to process your emotions and reflect on your experiences

| Category | Description |

|---|---|

| Physical Self-Care | Activities that promote physical well-being, such as exercise, healthy eating, and sleep |

| Emotional Self-Care | Practices that nurture emotional health, such as meditation, journaling, and therapy |

| Mental Self-Care | Strategies that support mental well-being, such as learning, problem-solving, and creative pursuits |

| Social Self-Care | Activities that foster social connections, such as spending time with loved ones, joining clubs, or volunteering |

Building Resilience in the Face of Turbulence

In the midst of unpredictable events, strength lies not in avoiding the turmoil, but in adapting to the ever-changing landscape. As uncertainty becomes the new normal, resilience takes center stage as a crucial skill to navigate the challenges head-on. One effective way to develop this resilience is by cultivating a strong support network, which can be achieved by:

- Building relationships based on trust and open communication.

- Identifying reliable sources of information to stay informed.

- Participating in online communities to broaden your perspective.

- Collaborating with others to build mutually beneficial partnerships.

- Developing a growth mindset, embracing challenges as opportunities for growth.

Developing resilience also requires a commitment to self-care and stress management. This includes maintaining a healthy work-life balance, engaging in regular physical activity, and practicing mindfulness techniques to reduce stress and anxiety. Effective stress management can be achieved through relaxation techniques , time management, and establishing a daily routine. The benefits of self-care and stress management are well-documented, with stress reduction resulting in:

| Benefits of Self-Care | Outcomes |

|---|---|

| Improved mental health | Increased emotional intelligence |

| Reducing stress and anxiety | Enhanced problem-solving skills |

| Boosting self-esteem | Improved relationships |

The Hidden Patterns Beneath the Surface

The intricacies of the DCF universe are often shrouded in mystery, with the underlying dynamics governing the relationships between variables remaining obscure. To unravel this enigma, one must delve into the realm of patterns, where seemingly unrelated phenomena coalesce into a coherent narrative. Beneath the apparent randomness, the following patterns can be discerned:

- Fractal resonance: A self-similar pattern repeated across various scales, demonstrating an intrinsic interconnectedness between disparate elements.

- Feedback loops: Cycles of causality where the output of a system becomes the input, generating a continuous cycle of change and adaptation.

- Emulation and convergence**: Independent entities mirroring each other’s behaviors, suggesting a global coherence that transcends individual occurrences.

| DCF Pattern | Corresponding Phenomena |

|---|---|

| Fractal resonance | Repeating market cycles, resonant frequencies in physics |

| Feedback loops | Tipping points in climate change, self-reinforcing social trends |

| Emulation and convergence | Convergent evolution in biology, convergent cultural narratives |

Adapting to the Ever Changing DCF Landscape

In the DCF universe, nothing remains constant except change. As the landscape continues to shift, it’s essential to stay adaptable to navigate the complexities of the ever-evolving world of discounted cash flow analysis. One way to approach this is by developing a flexible mindset, where assumptions are continually challenged and recalibrated. This mindset allows for a smoother transition as new information becomes available, and the ability to pivot when circumstances change.

When it comes to building DCF models, modularity and scalability are key. This allows for seamless integration of new data points, assumptions, and scenarios, making it easier to respond to changes in the market or company performance. By breaking down complex models into smaller, more manageable components, users can quickly identify areas of sensitivity and make adjustments as needed. This approach enables users to stay one step ahead in the DCF universe, where uncertainty is the only constant.

- Characteristics of adaptable DCF models:

- Modular design

- Flexibility to accommodate changing assumptions

- Scalability to handle increasing complexity

- Ability to integrate new data points and scenarios

| Stage | Key Characteristics |

|---|---|

| Traditional | Simplified assumptions, single-point estimates |

| Advanced | Probabilistic modeling, decision trees |

| Dynamic | Real-time data integration, scenario planning |

This table illustrates the evolution of DCF analysis, from traditional to dynamic, highlighting key characteristics and advancements.

Harnessing the Power of Chaos for Strategic Advantage

Harnessing chaos requires an organization to be adaptable and responsive to change. By embracing this attribute, companies can transform unstructured and unpredictable events into valuable learning experiences. When leveraged effectively, these experiences can provide a competitive edge and drive business growth. In a chaotic environment, organizations that succeed are those that:

- Stay agile: Develop a culture that encourages quick decision-making and prompt action.

- Monitor and learn: Establish systems to observe and analyze the environment for potential risks and opportunities.

- Encourage experimentation: Allow teams to take calculated risks and engage in creative problem-solving.

- Maintain flexibility: Prioritize processes over rigid structures to facilitate effortless adjustments.

| Characteristics of Chaotic Environments | DFC Response |

|---|---|

| Unpredictability | Develop multiple scenarios and contingency plans |

| Interconnectedness | Foster cross-functional collaboration and partnerships |

| Rapid Change | Prioritize continuous learning and innovation |

Final Thoughts

In the grand tapestry of the DCF universe, chaos theory weaves a complex narrative of unpredictability and fascinating disorder. As we navigate the intricate dance of variables and outcomes, we find ourselves drawn into a world where the merest flutter of a butterfly’s wings can send shockwaves through the very fabric of reality. And yet, it is within this maelstrom of uncertainty that we discover the true beauty of the DCF universe. A realm where the forces of disorder and randomness converge to create an ever-changing landscape of possibility and surprise. As we close this exploration of the chaos theory of the DCF universe, we are left with more questions than answers. But it is in the asking of these questions, in the pursuit of understanding the intricate workings of this complex cosmos, that we find the true value of this journey. For it is not the prediction of outcomes that matters, but the thrill of the journey itself. The journey into the unknown, where the only constant is change, and the beauty of chaos reigns supreme. In the vast expanse of the DC Comics universe, a multitude of characters, storylines, and plot twists have coalesced to form a rich tapestry of intricate relationships and unpredictable outcomes. Within this complex framework, a fascinating phenomenon has begun to emerge – the Chaos Theory of the DCF Universe. Like the butterfly effect in meteorology, where the flapping of wings can trigger a hurricane, even the smallest actions and events in this universe can set off chain reactions, birthing alternate realities and unforeseen realities. In this realm, the slightest adjustments can reshape entire worlds, testing the boundaries of the reader’s imagination and making the seemingly improbable, utterly possible. So, lock your doors, hide your Bat-alarms, and strap on your crash helmet, as we’re about to dive headfirst into the kaleidoscope of “The Chaos Theory of the DCF Universe” – and the weird, wonderful chaos that ensues.

Navigating the Complex Web of Variables

Navigating the intricate pathways of discounted cash flow (DCF) valuations can be likened to traversing a labyrinth, where every twist and turn presents an unexpected variable. Market analysts and financial modelers alike are often faced with the daunting task of incorporating complexities and reconciling divergent forecasts. Key factors influencing this uncharted territory include:

- Volatility in market sentiment, where fluctuations in investor attitudes profoundly impact projected cash flows.

- Regulatory factors and macroeconomic conditions, which can either augment or diminish an organization’s revenue and profitability prospects.

Just as the gentle flutter of a butterfly’s wings can precipitate a tempest, so too can small discrepancies in DCF inputs amplify to become profound risks, affecting both profit projections and stakeholders’ interests. As a case in point, consider the subtle yet profound impact of altering one’s discount rate (WACC) on valuation outcomes:

| Discount Rate (WACC) | Resultant Valuation Outcome (per share) |

|---|---|

| 8.0% | $252.50 |

| 9.5% | $182.20 |

| 11.0% | $132.15 |

Small adjustments in valuation estimates can yield vastly divergent results, creating an environment where both precision and proactive adaptability become the hallmarks of navigable success within this complex DCF realm.

Understanding the Butterfly Effect in DCF Universe

Small actions have tremendous power to shape the DCF universe, making it an fascinating yet unpredictable world. Much like the flapping of a butterfly’s wings, which is said to cause a hurricane on the other side of the world, the effects of seemingly insignificant decisions in the DCF universe can have far-reaching consequences. From the way a figure is displayed on a spreadsheet to the way a cash flow is predicted, the smallest change can set off a chain of reactions that significantly impact the final outcome.

This unpredictability is rooted in the intricate nature of the DCF universe, which is characterized by complex relationships and high sensitivity to initial conditions. Despite this volatility, understanding the butterfly effect can empower DCF analysts and professionals to be more proactive and meticulous in their work, recognizing the potential consequences of even the smallest actions.

| Small Action | Potential Outcome |

| A change in growth rate assumption | Significant variation in the valuation result |

| A revision in the capital structure | Impact on the weighted average cost of capital |

| A different terminal value estimate | Effects on the present value of the cash flows |

- Sensitivity testing: Understanding the effects of small changes on the final outcome can help DCF analysts refine their models and improve accuracy.

- Modeling assumptions: Identifying the key assumptions that drive the valuation results can enable more informed decision-making.

- Scenario planning: Recognizing the potential impact of small actions can promote more proactive strategic planning and contingency preparation.

Fractals and Self Similarity in DCF Chaos

The intricate patterns that govern the universe’s complex systems are a subject of fascination for scientists and mathematicians alike. Among these patterns, fractals and self-similarity play a pivotal role in understanding the chaos that unfolds in the DCF universe. Fractals exhibit a unique property – they appear the same at different scales, with their patterns repeating infinitely, fostering an atmosphere of predictability within the chaotic realm.

These geometric wonders have far-reaching implications in the DCF universe, as they govern various aspects such as the distribution of matter and energy. To illustrate this, consider the following examples:

- The branch-like structure of galaxies, where smaller units mirror the shape of the larger ones.

- Cosmic microwave background radiation patterns, featuring intricate webs of energy that echo the universe’s early configuration.

- Turbulent fluid dynamics, with swirling currents that display self-similar features across multiple scales.

By examining these patterns, researchers can gain insight into the intricate web that binds the universe together. Furthermore, studies have identified key characteristics that are evident in fractals and self-similar systems:

| Characteristics | Description |

|---|---|

| Scaling Symmetry | The property of displaying the same pattern at multiple scales. |

| Infinite Complexity | The existence of intricate details at every scale. |

Predicting the Unpredictable Unfolding of Events

Predicting the future in the DCF universe is akin to trying to forecast the trajectory of a butterfly’s flight. The inherent complexities and intricacies of the universe’s dynamics render predictions prone to error. Even with the most advanced tools and models, uncertainty remains an overriding factor. The key to navigating these uncertainties lies in understanding the underlying principles that govern the universe’s behavior.

In a realm characterized by the interconnectedness of disparate elements, small changes can have far-reaching and unpredictable effects. Consider the following factors that contribute to the complex nature of the DCF universe:

- Flux Intensification: The acceleration of information and idea proliferation, leading to unforeseen consequences.

- Nodal Interactions: The confluence of power nodes, influencing the dynamic equilibrium of the universe.

- Emergent Properties: The manifestation of unforeseen properties and behaviors, arising from complex interactions.

- Feedback Loops: The recursive influence of past events on the present, shaping future outcomes.

| Initial Conditions | Small Change | Unpredictable Outcomes | |

|---|---|---|---|

| Physical Systems | Sensitive dependence | Butterfly effect | Unforeseen weather patterns |

| Social Dynamics | Interconnected networks | Influential actions | Far-reaching social movements |

| Economic Fluctuations | Market sensitivities | Minor market shifts | Avalanche-like economic downturns |

Influencing the Outcome Through Strategic Intervention

Within the complex dynamics of the DCF universe, entities can exercise control over specific variables to shape the course of events. This can be achieved through intentional actions or calculated inactions, generating a ripple effect throughout the system. Strategic manipulation of key factors can amplify or mitigate the Butterfly Effect, leading to more desirable or chaotic outcomes.

- Seeding targeted information within influential networks

- Calibrating systemic parameters to induce resonance

- Data-driven decision making to harmonize or disrupt patterns

- Identification of critical phase transitions to introduce change

- Intentional non-intervention to allow events to unfold naturally

| Strategic Intervention Types | Potential Outcomes |

|---|---|

| Proactive | Reduced uncertainty, increased stability |

| Reactive | Minimized risk, conservation of resources |

| Adaptive | Emergence of novel patterns, growth |

| Predictive | Accuracy in forecasting, efficiency |

Embracing the Uncertainty Principle in DCF

At its core, the uncertainty principle in DCF analysis revolves around the inherent unpredictability of future cash flows and discount rates, casting a shadow of doubt over the reliability of the calculated present value. Rather than trying to mitigate this uncertainty through futile attempts to conjure precise predictions, it may be wiser to acknowledge and even embrace the chaos, understanding that an element of unpredictability will always be present. By doing so, we open ourselves up to a more flexible and adaptive approach, one that acknowledges the fluidity of market conditions and business performance. The result is a more nuanced understanding of the investment, one that acknowledges both its potential and its limitations.

This paradigm shift can be achieved by incorporating the following elements into the DCF analysis:

- Sensitivity Analysis: By testing different scenarios and outcomes, we can develop a sense of how sensitive our results are to changes in assumptions, allowing us to identify areas where risks are more pronounced.

- Probability-Weighted Cash Flows: Assigning probabilities to different cash flow outcomes enables us to incorporate our best guess of future events, while still acknowledging the uncertainty.

- Adjusting for Increased Uncertainty: By increasing the discount rate or adjusting the terminal growth rate, we can reflect our growing unease with an investment’s prospects, resulting in a more balanced valuation.

It’s interesting to note how “certainty” and “probability” are often at odds in DCF. As shown in the table below, the truth lies in acknowledging that even the most fundamental calculations are just attempts to chart our way through a stormy sea, not to provide an exactitude that does not exist.

| Investment Decisions | Certainty | Probability |

|---|---|---|

| Flawless predictions | High | 0% |

| Accepting some degree of risk | Medium | 50% |

| Embracing chaos and unpredictability | Low | 100% |

Ultimately, it is only once we accept our limitations and confront the inherent uncertainty head-on that we can unlock a deeper understanding of the investment universe and its many mysteries.

Coping Mechanisms for Managing Chaos and Uncertainty

When faced with the unpredictable nature of the DCF universe, it’s essential to develop strategies that allow you to navigate through the challenges with greater ease. One approach is to reframe your thinking, shifting your focus from the chaos itself to the opportunities it presents. By doing so, you can transform uncertainty into a catalyst for growth and innovation. This mindset adjustment enables you to proactively seek solutions rather than simply reacting to the ever-changing environment.

Another approach is to employ grounding techniques to maintain your emotional balance amidst the turmoil. These methods can help you stay centered and composed, even in the face of uncertainty. Some effective grounding techniques include:

- Mindfulness meditation, which encourages you to stay present in the moment and observe your thoughts without judgment

- Deep breathing exercises, which can help calm your nervous system and reduce stress

- Physical activity, such as walking or yoga, which can release endorphins and promote relaxation

- Journaling, which allows you to process your emotions and reflect on your experiences

| Category | Description |

|---|---|

| Physical Self-Care | Activities that promote physical well-being, such as exercise, healthy eating, and sleep |

| Emotional Self-Care | Practices that nurture emotional health, such as meditation, journaling, and therapy |

| Mental Self-Care | Strategies that support mental well-being, such as learning, problem-solving, and creative pursuits |

| Social Self-Care | Activities that foster social connections, such as spending time with loved ones, joining clubs, or volunteering |

Building Resilience in the Face of Turbulence

In the midst of unpredictable events, strength lies not in avoiding the turmoil, but in adapting to the ever-changing landscape. As uncertainty becomes the new normal, resilience takes center stage as a crucial skill to navigate the challenges head-on. One effective way to develop this resilience is by cultivating a strong support network, which can be achieved by:

- Building relationships based on trust and open communication.

- Identifying reliable sources of information to stay informed.

- Participating in online communities to broaden your perspective.

- Collaborating with others to build mutually beneficial partnerships.

- Developing a growth mindset, embracing challenges as opportunities for growth.

Developing resilience also requires a commitment to self-care and stress management. This includes maintaining a healthy work-life balance, engaging in regular physical activity, and practicing mindfulness techniques to reduce stress and anxiety. Effective stress management can be achieved through relaxation techniques , time management, and establishing a daily routine. The benefits of self-care and stress management are well-documented, with stress reduction resulting in:

| Benefits of Self-Care | Outcomes |

|---|---|

| Improved mental health | Increased emotional intelligence |

| Reducing stress and anxiety | Enhanced problem-solving skills |

| Boosting self-esteem | Improved relationships |

The Hidden Patterns Beneath the Surface

The intricacies of the DCF universe are often shrouded in mystery, with the underlying dynamics governing the relationships between variables remaining obscure. To unravel this enigma, one must delve into the realm of patterns, where seemingly unrelated phenomena coalesce into a coherent narrative. Beneath the apparent randomness, the following patterns can be discerned:

- Fractal resonance: A self-similar pattern repeated across various scales, demonstrating an intrinsic interconnectedness between disparate elements.

- Feedback loops: Cycles of causality where the output of a system becomes the input, generating a continuous cycle of change and adaptation.

- Emulation and convergence**: Independent entities mirroring each other’s behaviors, suggesting a global coherence that transcends individual occurrences.

| DCF Pattern | Corresponding Phenomena |

|---|---|

| Fractal resonance | Repeating market cycles, resonant frequencies in physics |

| Feedback loops | Tipping points in climate change, self-reinforcing social trends |

| Emulation and convergence | Convergent evolution in biology, convergent cultural narratives |

Adapting to the Ever Changing DCF Landscape

In the DCF universe, nothing remains constant except change. As the landscape continues to shift, it’s essential to stay adaptable to navigate the complexities of the ever-evolving world of discounted cash flow analysis. One way to approach this is by developing a flexible mindset, where assumptions are continually challenged and recalibrated. This mindset allows for a smoother transition as new information becomes available, and the ability to pivot when circumstances change.

When it comes to building DCF models, modularity and scalability are key. This allows for seamless integration of new data points, assumptions, and scenarios, making it easier to respond to changes in the market or company performance. By breaking down complex models into smaller, more manageable components, users can quickly identify areas of sensitivity and make adjustments as needed. This approach enables users to stay one step ahead in the DCF universe, where uncertainty is the only constant.

- Characteristics of adaptable DCF models:

- Modular design

- Flexibility to accommodate changing assumptions

- Scalability to handle increasing complexity

- Ability to integrate new data points and scenarios

| Stage | Key Characteristics |

|---|---|

| Traditional | Simplified assumptions, single-point estimates |

| Advanced | Probabilistic modeling, decision trees |

| Dynamic | Real-time data integration, scenario planning |

This table illustrates the evolution of DCF analysis, from traditional to dynamic, highlighting key characteristics and advancements.

Harnessing the Power of Chaos for Strategic Advantage

Harnessing chaos requires an organization to be adaptable and responsive to change. By embracing this attribute, companies can transform unstructured and unpredictable events into valuable learning experiences. When leveraged effectively, these experiences can provide a competitive edge and drive business growth. In a chaotic environment, organizations that succeed are those that:

- Stay agile: Develop a culture that encourages quick decision-making and prompt action.

- Monitor and learn: Establish systems to observe and analyze the environment for potential risks and opportunities.

- Encourage experimentation: Allow teams to take calculated risks and engage in creative problem-solving.

- Maintain flexibility: Prioritize processes over rigid structures to facilitate effortless adjustments.

| Characteristics of Chaotic Environments | DFC Response |

|---|---|

| Unpredictability | Develop multiple scenarios and contingency plans |

| Interconnectedness | Foster cross-functional collaboration and partnerships |

| Rapid Change | Prioritize continuous learning and innovation |